Lets Discuss Employee Provident Fund (EPF) Withdrawals and Universal Account Number (UAN)

As the headline suggests, lets talk about Employee Provident Fund (EPF) Withdrawals and Universal Account Number (UAN). We all must have heard that the EPFO (Employee provident fund organisation) has gone through major overhaul since last 2 years and now apparently they have made it easier for us (The salaried professionals) to withdraw money from our EPF accounts, here, we will discuss everything related to EPF in details and see if they have actually made the withdrawl process easier and less complex for us or not. First of all, Let`s clear our thoughts on

EPF and UAN (Universal Account number)

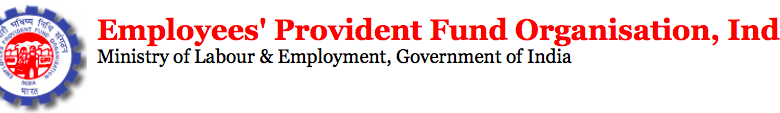

As per the new rule, each and every employee who has a PF account must generate/Create/Update there UAN number, so ppl if you don’t know your UAN number kindly contact your Employer to give you your UAN number.

The Answer is UAN (Universal Account Number) is a permanent account number just like your PAN number and it does not replaces the existing PF numbers, so instead what happens is Your PF number gets mapped below your UAN number and as you change jobs, your new PF numbers gets mapped under you UAN number, so hypothetically, if since last 2 years you have changed 3 jobs, you UAN number should have three different PF numbers mapped under it. So, the action point is, once you change your Job, give your UAN number to the new company and ask them to map your new PF under that UAN number, Mind you some companys try to create new UAN for you even if you already have a UAN number, don’t let that happen.

UAN with KYC details and e-verified from Employer

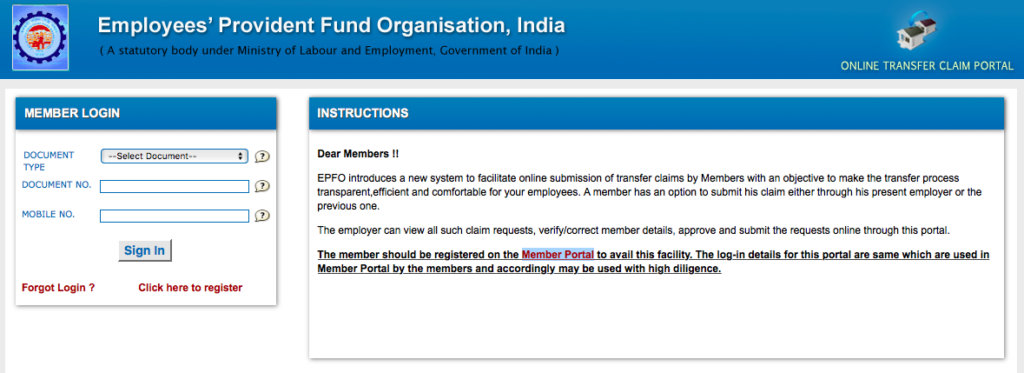

HOW to transfer OLD PF amount to NEW PF Number

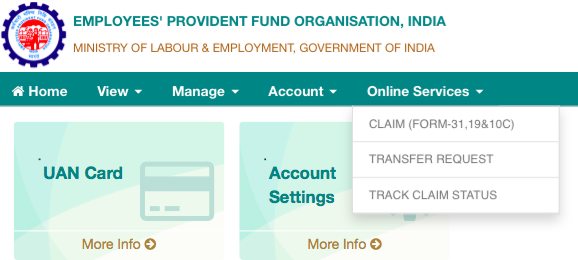

After login In, click on Request for transfer of account

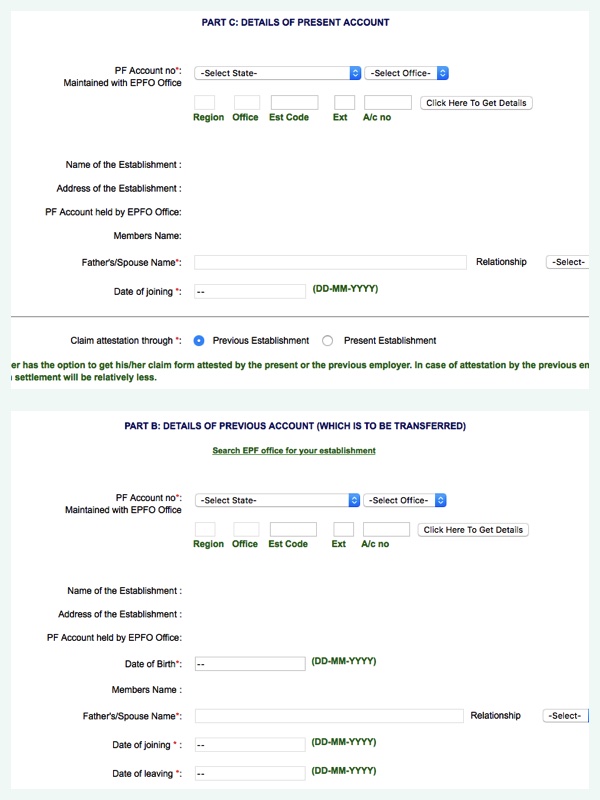

After login In, click on Request for transfer of account  In the transfer request page, you will be required to update the PF details of your previous account and your current account

In the transfer request page, you will be required to update the PF details of your previous account and your current account

PF Withdrawl

This is the part where most of us are confused, while the government has simplified the PF withdrawl process since now you can apply for PF withdrawal online (With Adhaar authentication), the eligibility for PF withdrawl is still a complex point to understand.

- PF final Settlement: Final settlement is possible only if you are not going to work any more, that means if you are retiring than you can do final settlement or if you are not going to work anymore, final settlement is possible after 90 days of the PF account being dormant / Unused.

If you resign and join a new company then you have to submit your UAN to the new company and the government will know that you are still working and thus you are not allowed to do final settlement of your previous PF account, You can only transfer the PF amount from the previous PF number to the new PF number.

- PF Partial withdrawl: PF part withwral is allowed for certain list of purposes only, and mind you any withdrawal before 5 years of service will attract heavy income tax, after 5 years of service its TAX free.

Reasons For which you can withdraw PF

- For House Building or Flat purchase or Land Purchase: You need to complete 3 years of service, here the catch is, if you have registered your previous Pf accounts under the same UAN number and transferred previous amount to Current PF account, than they will consider your service duration for both the PF accounts under your UAN number, You just need to prove that you are working for last 3 years, not necessarily in the same organisation, hence different PF accounts. NO SUPPORTING DOCUMENTS REQUIRED, ONLY SELF ASSESTATION / DECLARATION IS ENOUGH.

- For treatment of family Members Illness: Again the same eligibility criteria as the previous point, but here you will require a doctors certificate you apply for PF advance for this reason.

- Childrens And family members Marrage, Children’s Post matriculation education, Purchase of Equipment for Physically handicapped and natural calamity of exceptional case: For all these reasons, the same eligibility criteria applies of 3 years service and NO SUPPORTING DOCUMENTS REQUIRED, ONLY SELF ASSESTATION / DECLARATION IS ENOUGH.

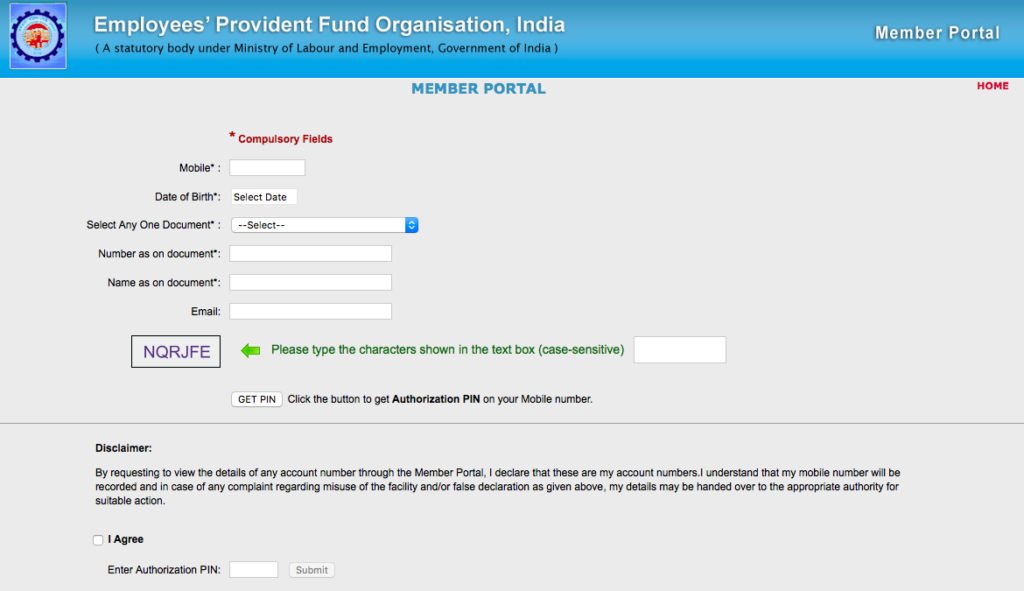

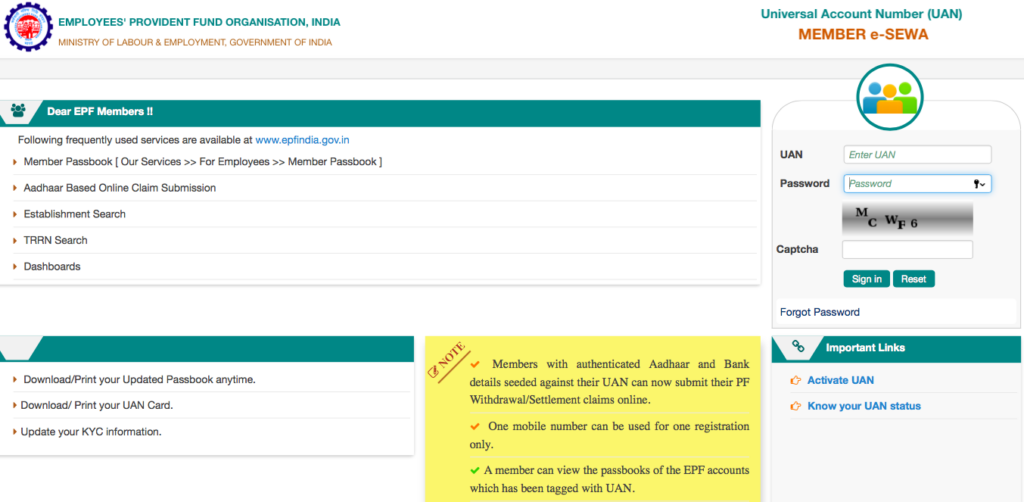

To withdraw PF online, login to the follow links

“https://unifiedportal-mem.epfindia.gov.in/memberinterface/”

Conclusion:

Its true that the government have simplified the PF Transfer, Partial-withwral and Final settlement process, however to get the benefit of the simplified process there are many requisites like Adhaar No, UAN, KYC verification etc, we know these documents / authentications are required to avoid misuse of the PF funds, But we think the process needs to be more simplified and transparent, we believe this a move to the rite direction and in future we should see that the process to be greatly simplified. For Employees / EPF Subscribers like you and me, the common man, it is in our best interest to Check the following points, these points will help us is smooth processing of PF withdwrals.

- Ask your Employer and Know your UAN or Create your UAN

- Activate your UAN

- Upload KYC details (Adhaar – PAN – Bank Details with Cancelled Check) in the UAN website.

- GET the KYC Verified Online with your Employer in UAN website.

- Transfer any previous PF amount to your Current PF Number.